Note: This article is part two in an ongoing series about growth.

Let’s start with some timeless principles.

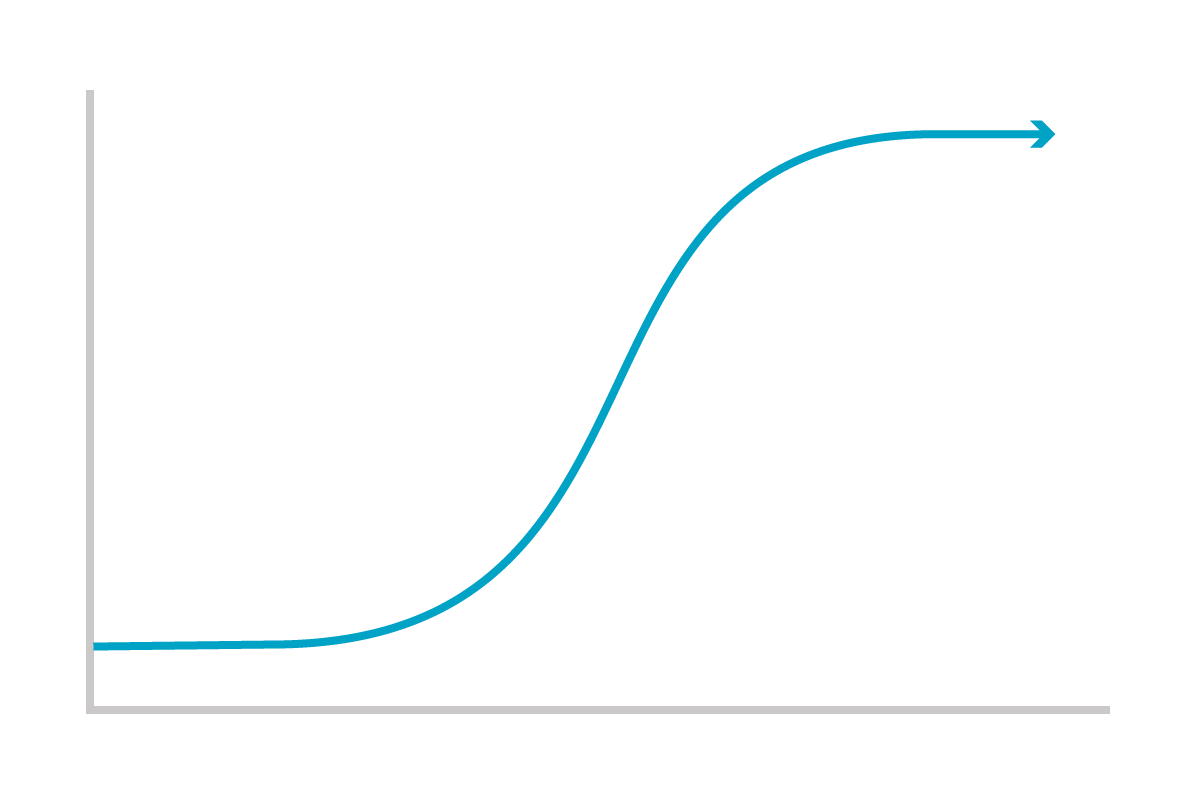

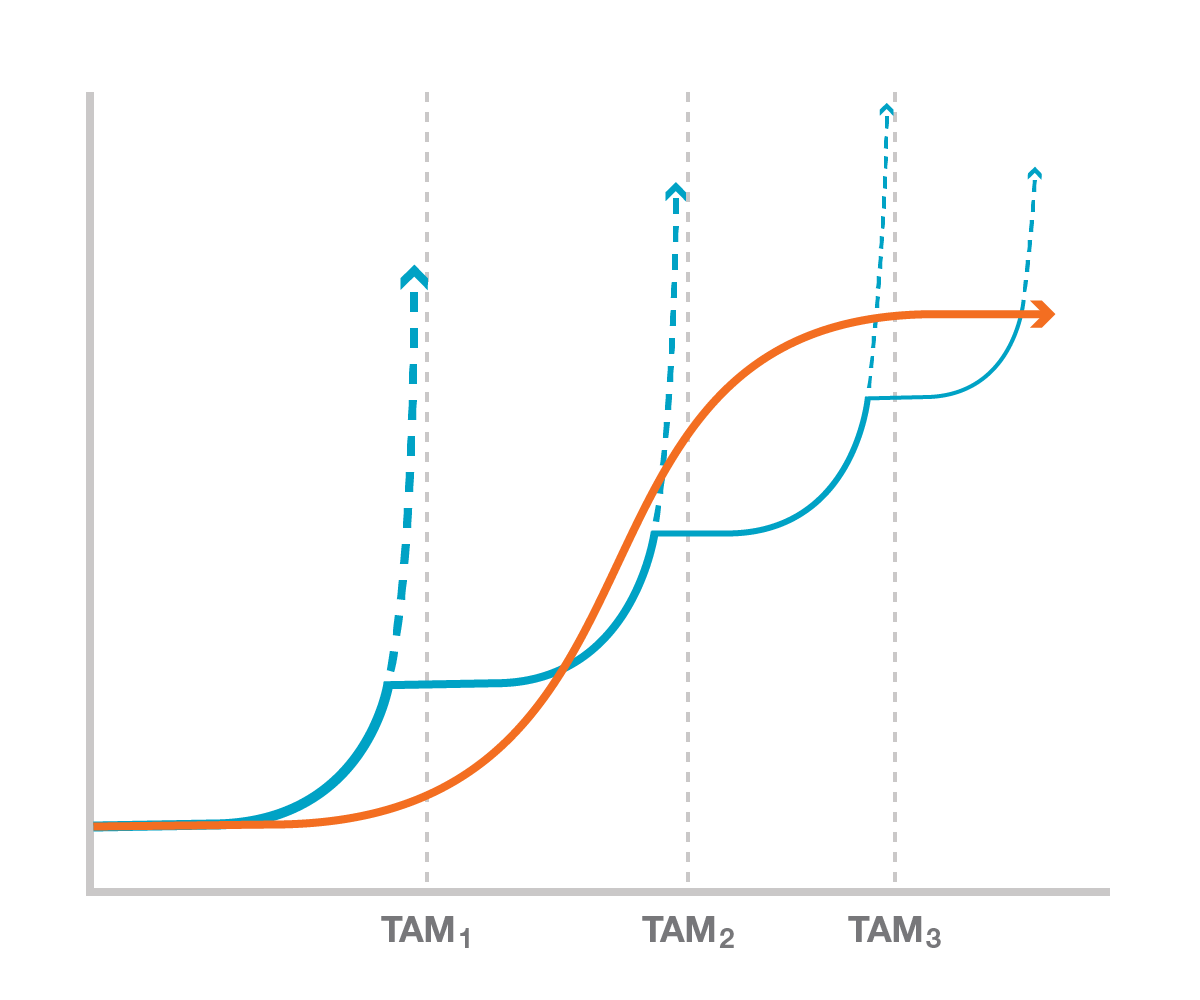

All businesses grow like this:

Geoffrey West has modeled this curve mathematically, and per his research, it’s consistent for all SMBs, all startups, all nonprofits—all businesses.

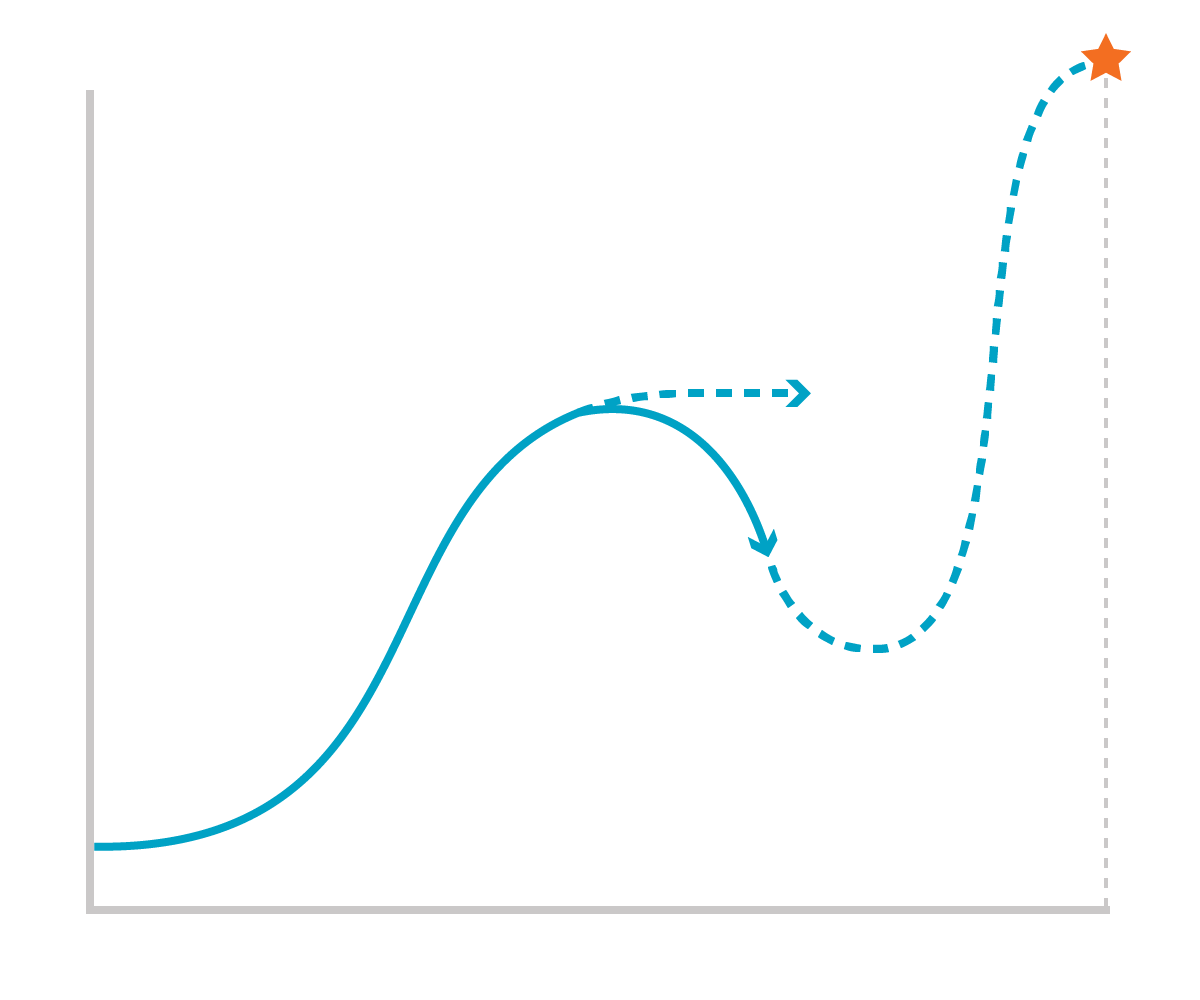

Organizations are not perpetual motion machines, of course. They are complex systems. If they don’t respond to new stimuli and find ongoing sources of fuel, they expire. Once an organization has avoided its problems for too long, the slope changes:

This becomes a transition moment where new goals must be set, and internal systems must be refreshed or replaced to go after a more ambitious vision:

I sometimes refer to these as “oh shift” moments because (a) my sense of humor is questionable, and (b) typically the internal culture, external conditions, brand, website, technology systems, and business model are all changing at the same time.

Here is what these moments can look like for different kinds of organizations:

- A startup saturates its initial Total Addressable Market and must now penetrate new markets to secure the next round of investor funding. Otherwise, it becomes a zombie company (alive but unable to grow) or else collapses outright.

- A small business, after coasting successfully for a few years, hits a bad patch where internal relationships and existing technology systems break down. Investing in new infrastructure and staff requires a pool of assets. If this pool doesn’t exist, the company collapses.

- A nonprofit opera company finds that it needs dramatic increases in donations to compete with new entertainment options like Netflix and to make its programming relevant to a new generation of potential ticket buyers. This requires an overhaul of the board to bring in more “rainmakers,” but the board is resistant to seeing that it must replace itself.

- An enterprise engages in value extraction and management theater for years to distract investors from the flagging business. After a few really bad quarters, “suddenly” the shareholder trust is gone, and the CEO is out. The new leader must cohere and execute a new vision quickly or else the company faces bankruptcy.

I’ve been a consultant for almost 25 years, and so I know these transition moments very well: it’s when a consultant is usually called in. An outsider who has “a missing or dismantled sacredness module” (h/t Venkat Rao) can act as a midwife to effect a safe transition to the next phase.

These reinventions and turnarounds often feel hopelessly unique and specific to the internal teams caught in them, but at the level of dynamic complexity, the patterns are all the same.

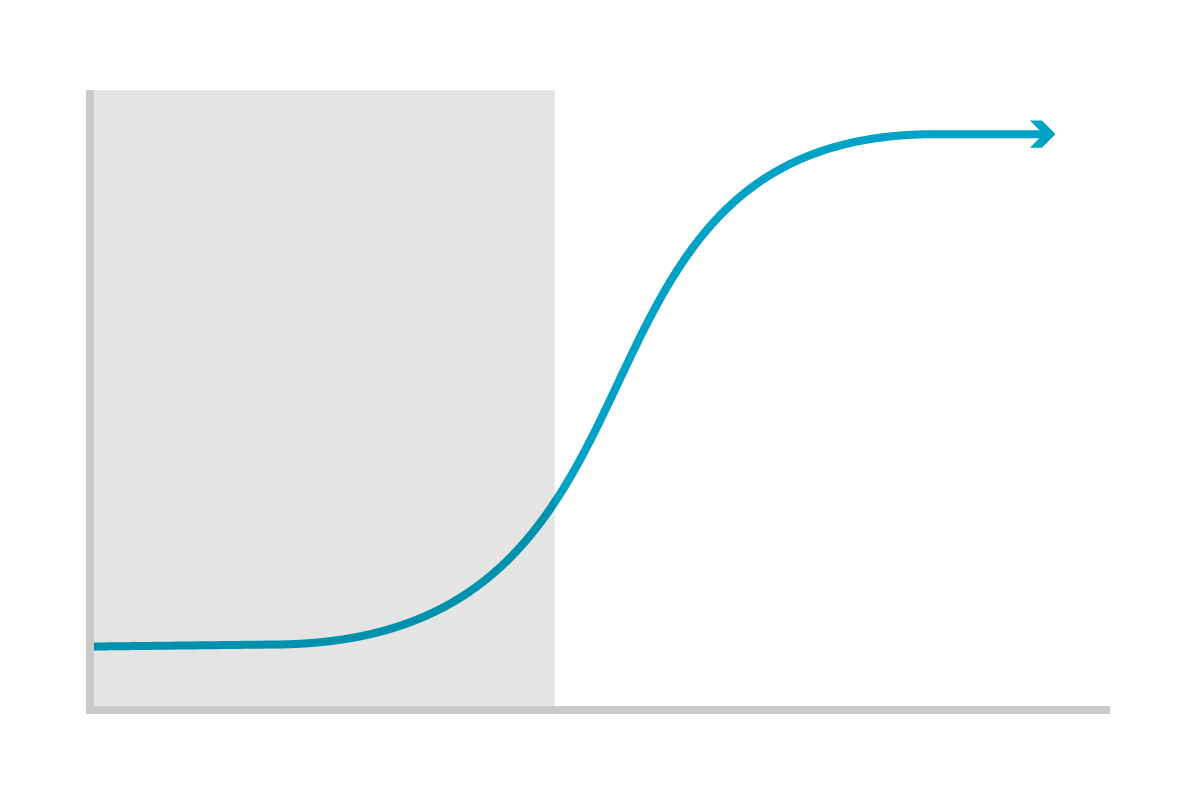

An experienced CEO or management team who has been through this evolution once before typically never wants to do so again, and so they wisely and proactively invest in the future and don’t wait for the existing systems to break or the current market to mature. Jeff Jordan of Andreessen Horowitz draws a sequence of continuing advances that doesn’t include fumbles and fails, and indeed, these transitions can be managed gracefully if and when the company is prepared.

Similarly, in The E-Myth Revisited, Michael Gerber advises small business owners to resist throwing themselves into service delivery and instead focus from day one on the operational health of the business. In my experience, this can be unrealistic because businesses are human organizations, and therefore complex. Anticipating and weathering transitions tends to be something that can’t be taught, only learned. Most businesses focus at first on doing one thing, become optimally efficient at it, and then realize they really should have been doing something else.

The “oh shift” moment could come in year one of a business or year ten—and it will always come again. That’s just how it goes.

There is no hockey stick

A pervasive myth about startups is that they constitute a fundamentally different kind of business. Theoretically, unlike an enterprise, SMB, or nonprofit, they experience “hockey stick” growth when they’re successful, and managing this wild ride from seed stage venture to colossus is a unique and ineffable experience. And true, VC investment acts like steroids, giving young startups access to reserves that allow them to grow by leaps and bounds. (Startups that ignore the mandatory growth expectations of VC investors do so at their own peril.)

But the growth curve for startups is the same as the one I drew above. My diagram above showed a hockey stick, too: did you see it?

Spoiler—it was just turned on its side:

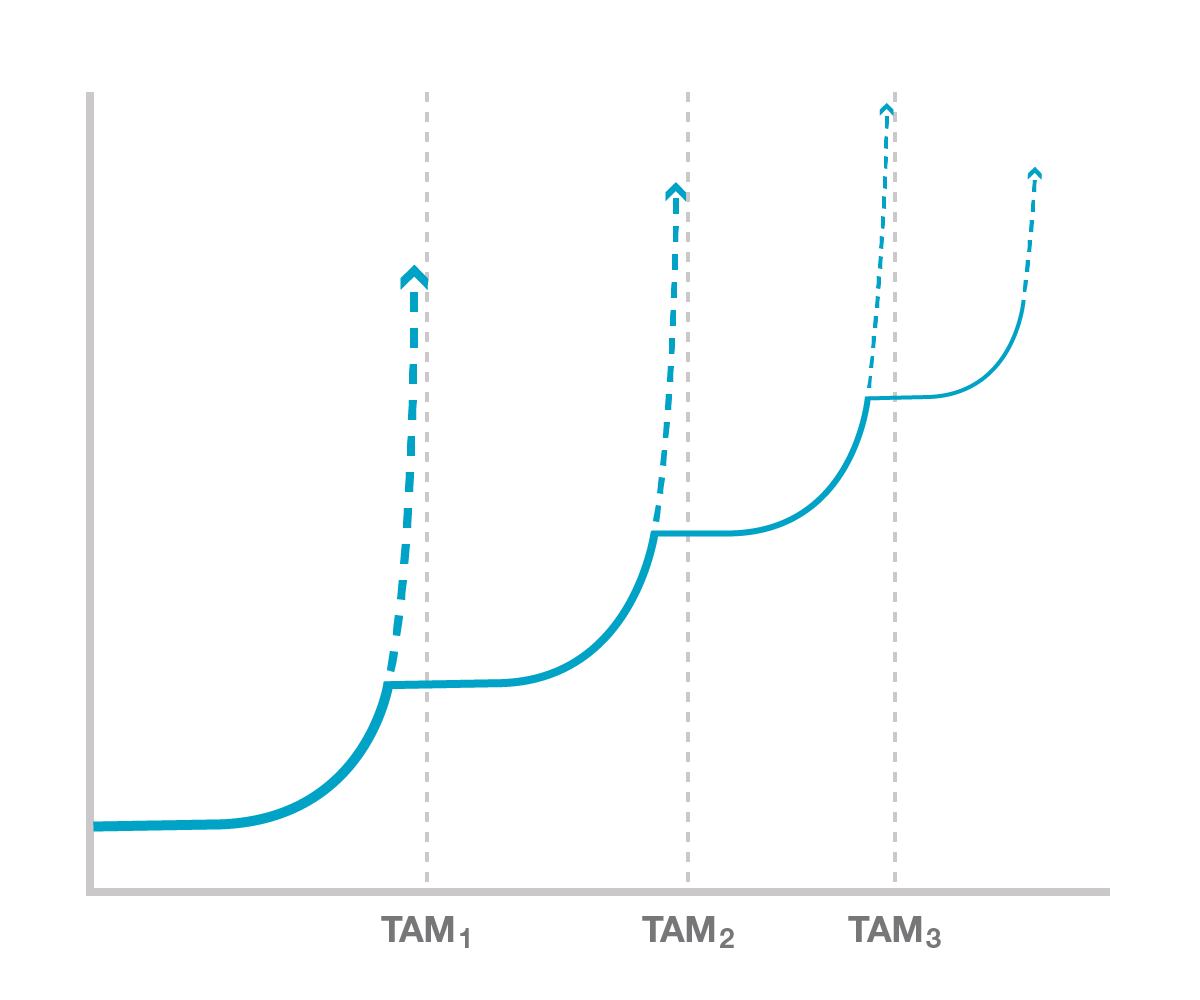

The graph in the original version showed value creation over time; rotated then flipped, it shows market penetration. And if we keep the latter, “portrait” orientation and add Jeff Jordan’s follow-on phases of hypergrowth, we get something like this:

This, in fact, mirrors exactly the graphs that Geoffrey West has built, showing mathematically the fate of all companies. And if we assume these transition moments as “givens” and connect them, our curve once again becomes sigmoidal.

You can’t escape fate.

I talked about all of this years ago in a blogpost entitled “Built to Leap” which emphasized that all businesses must master “leading while leaping”—i.e., maximizing the current opportunity (execution risk), while actively pursuing the next one (strategic risk). Practically and day-to-day, this involves constant tradeoffs between short- and long- term revenue.

All businesses, from barbershops to Google to the March of Dimes, go through this. Startups may have more data, money, people, and publicity than SMBs or some nonprofits, but these superficial differences mask a fundamental, shared reality. Size matters not.

Incidentally, if you want a real-time check of how well an organization is managing this balancing act, I recommend that you join the Marketing department. Marketing is often where the tradeoffs between short- and long- term revenue are most obvious and acute. I’ve written several articles that underline how the relative prioritization of short- and long-term TAM dictates an organization’s marketing approach, determining everything from goal-setting to positioning to funnel design.

I’ll have more to say about Marketing, and how marketing roles are changing, in my next post…

Next article: Hypergrowth basics

Leave a Reply